The Amritbaal Plan is aimed at ensuring financial stability for children as they transition into adulthood, providing guaranteed returns at maturity, as well as life cover. The plan is suitable for parents who want to invest early and secure a guaranteed maturity benefit

for their child. This plan can be customized to fit varying financial needs with different premium payment options, sum assured levels, and additional riders.

- Objective: A child-oriented policy to help parents secure funds for their children's education, marriage, or other significant life events.

- Entry Age: A child-oriented policy to help parents secure funds for their children's education, marriage, or other significant life events.

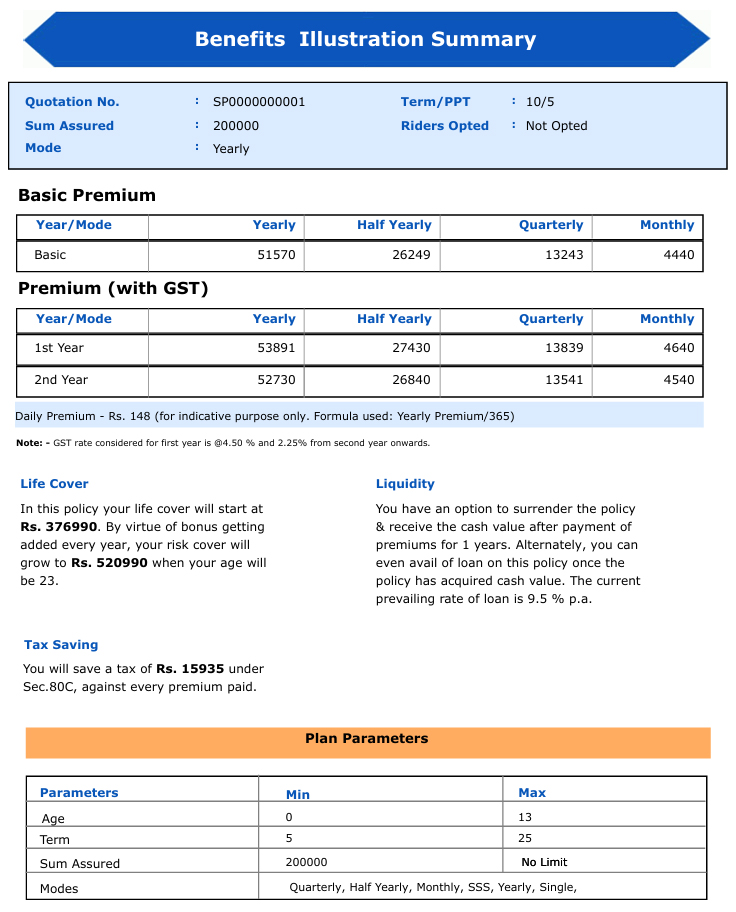

- Single Premium: A one-time premium payment where parents can pay upfront and secure their child’s future without any future liabilities. This is an ideal option for those who prefer to avoid long-term commitments.Policy terms range from 5 to 10 years.

- Limited Premium:Allows for premium payments over a fixed period of 5, 6, or 7 years. The limited premium option provides flexibility in terms of managing finances while ensuring the plan’s benefits remain intact. Policy terms range from 10 to 25 years, allowing parents to choose the term according to their long-term financial goals.

- Financial Security: Provides comprehensive financial protection for the child in case of unforeseen circumstances.

- Periodic Payouts: GEnsures a steady flow of funds during critical stages of the child’s life.

- Flexibility: Customize the plan according to future needs, such as education or marriage.

- Savings and Investment: Acts as a dual-benefit policy combining savings with life insurance protection.

- Loan Facility: Loan available against the policy after a specified period, ensuring liquidity in emergencies.

- Guaranteed Returns: Offers guaranteed payouts along with bonus additions declared by LIC.

- Peace of Mind: Parents can focus on nurturing their child’s dreams without financial worries.

- Life Cover for Parents: In some variants, additional coverage for the parent ensures continuity of financial goals.

- Death Benefit: Ensures that the child's financial needs are met even if the proposer is no longer around.

- Survival Benefits: Periodic payouts at specified ages or milestones.

- Maturity Benefit: A lump-sum payment at the end of the policy term, ensuring the child's financial independence.

- Tax Benefits: Tax deduction under Section 80C for premiums paid. | Tax exemption under Section 10(10D) for maturity and death benefits.

![]() 9840018033

9840018033