MUMBAI: LIC plans to take the acquisition route to get into the health insurance business, said MD & CEO Siddhartha Mohanty.

During the announcement of the company’s financial results for the first quarter, Mohanty said that the company is looking at an acquisition during the current financial year. “Rather than set up a vertical for insurance, we felt that we can acquire a company which will allow us to start selling health insurance across the country,” said Mohanty.

LIC has over 14.1 lakh agents, which is among the largest agency force among insurance companies worldwide. According to sources, most of the corporation’s agents are already distributing health insurance for other private companies as regulations permit an agent to work for life and non-life companies. These agents are expected to switch to selling LIC products.

Industry sources said that health insurance is increasingly becoming a ‘pull’ product, with many young buyers actively seeking coverage. This presents an opportunity for agents to engage with potential customers. Therefore, the availability of health insurance is expected to benefit the life insurance business as well.

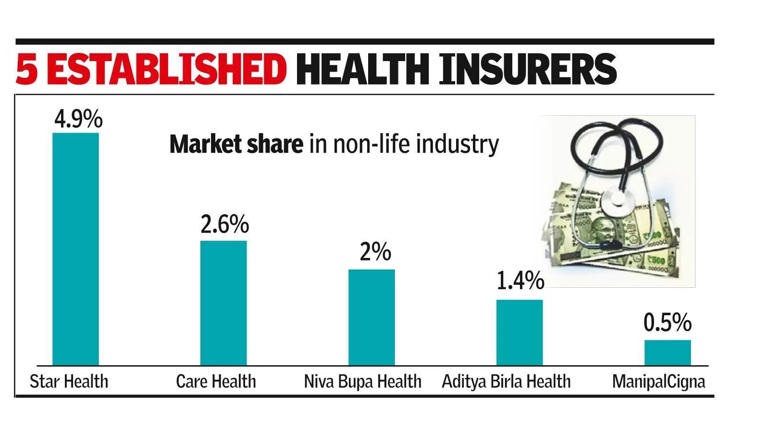

At present, there are five established standalone health insurance companies — Star Health & Allied Insurance, Niva Bupa, Aditya Birla Health Insurance, Care Health Insurance and ManipalCigna Health Insurance. The regulator has also recently granted permission to two other health insurers — Galaxy Health and Narayana Health.

LIC on Thursday reported a 9.6% increase in net profit for the June quarter, reaching Rs 10,461 crore compared to Rs 9,544 crore in the same period last year.

The corporation’s market share of first year premium income rose to 64%, up from 61.4% year-over-year. In the individual business segment, LIC held a 39.3% market share, while it dominated the group business with a 76.6% share.

Total premium income for the quarter increased by 15.7% to Rs 1,13,770 crore, compared to Rs 98,363 crore in the same quarter last year. The individual business premium grew by 7.04% to Rs 67,192 crore, while the group business premium rose by 30.9% to Rs 46,578 crore.

The value of new business for the quarter grew by 23.7% to Rs 1,610 crore, and the VNB margin improved by 20 basis points to 13.9%. LIC’s assets under management increased by 16.2% year-over-year, reaching Rs 54 lakh crore. Additionally, LIC’s solvency ratio improved to 2, up from 1.9 in the previous year. The overall expense ratio decreased by 98 basis points to 11.9%, reflecting improved operational efficiency.

![]() 9840018033

9840018033![]() 9840018033

9840018033